Decentralized Exchanges Dexs A New Era For Cryptocurrency Trading

The world of cryptocurrency trading is evolving at a breakneck pace, and one of the most significant developments in recent years is the rise of decentralized exchanges, or DEXs. These innovative platforms are transforming the way we buy, sell, and trade digital assets, and they’re fast becoming a game-changer for the industry.

- Getting Started With DeFi: Navigating The World Of Crypto And Decentralized Finance

- The NFT Revolution: A New Frontier In Digital Ownership

- Blockchain’s Ripple Effect: Revolutionizing The World Of Intellectual Property Rights

- Breaking Down Barriers: The Rise Of Interoperability In Blockchain

- Top Altcoins To Watch In 2024

So, what exactly are DEXs, and how do they work?

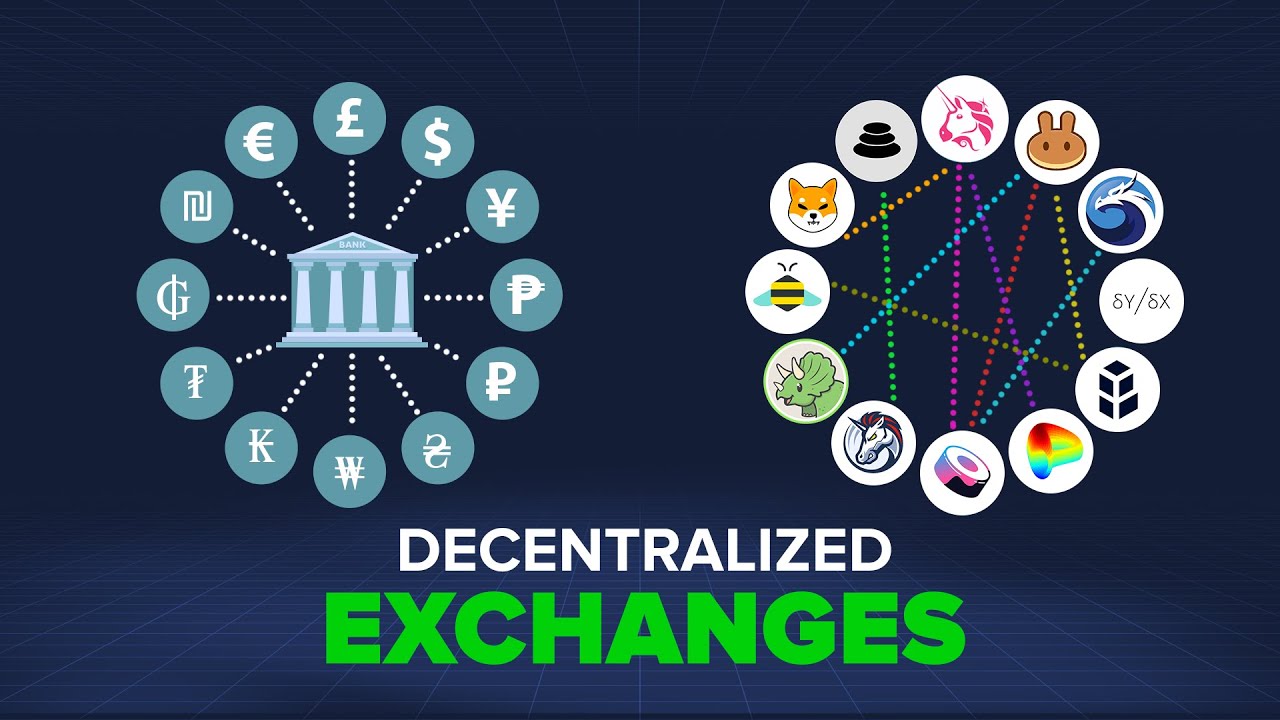

Traditional cryptocurrency exchanges, such as Coinbase or Binance, are centralized platforms that rely on intermediaries to facilitate trades. This means that users have to entrust their assets to the exchange, which can be a single point of failure if the exchange is hacked or compromised. On the other hand, DEXs operate on blockchain technology, which allows for peer-to-peer transactions without the need for intermediaries.

On a DEX, users can trade directly with each other, using smart contracts to execute transactions. This approach offers a number of advantages over traditional exchanges, including:

- Security: Because DEXs don’t hold users’ assets, they’re much less vulnerable to hacking and theft.

- Decentralization: DEXs are built on blockchain technology, which means that they’re resistant to censorship and can’t be shut down by a single entity.

- Transparency: All transactions on a DEX are recorded on the blockchain, which provides a transparent and tamper-proof record of all activity.

- Autonomy: Users have full control over their assets on a DEX, and can trade freely without relying on intermediaries.

One of the key features of DEXs is liquidity pools, which allow users to contribute to a shared pool of assets that are used to facilitate trades. Liquidity pools are essentially a decentralized version of a traditional order book, where traders can buy and sell assets in real-time.

Another exciting development in the world of DEXs is the emergence of decentralized oracles. These oracles provide external data feeds to the blockchain, allowing DEXs to access off-chain data and execute more complex trades.

So, what are some of the most popular DEXs out there?

- Uniswap: Launched in 2018, Uniswap is one of the oldest and most popular DEXs on the market.

- SushiSwap: SushiSwap is another well-known DEX that’s gained a significant following in recent years.

- Curve: Curve is a decentralized exchange that specializes in trading stablecoins and other low-volatility assets.

- dYdX: dYdX is a DEX that focuses on margin trading and lending, offering users the ability to trade with leverage.

As the world of cryptocurrency trading continues to evolve, it’s clear that DEXs are going to play a major role in shaping the future of the industry. With their decentralized, secure, and transparent approach, DEXs offer a number of advantages over traditional exchanges.

However, there are still some challenges to overcome before DEXs can reach their full potential. One of the main limitations of DEXs is their relatively low liquidity, which can make it difficult to execute large trades. Additionally, DEXs can be more complex to use than traditional exchanges, which can be a barrier for new users.

Despite these challenges, the future of DEXs looks bright. As the industry continues to evolve and mature, it’s likely that we’ll see more innovations and improvements in the world of decentralized exchanges. Whether you’re a seasoned trader or just starting out, it’s definitely worth exploring the world of DEXs and seeing what they have to offer.

In the end, the emergence of DEXs is a major development for the cryptocurrency industry, and it’s going to be exciting to see how they shape the future of trading.