Decentralized Finance: The Revolutionary Shift In Financial Power

Decentralized Finance: The Revolutionary Shift in Financial Power

- What Are Cross Chain Bridges And How Do They Work

- The Benefits Of Using Blockchain For Supply Chain Transparency

- The Rise Of Multisig Wallets Unlocking A New Level Of Security In Cryptocurrency Transactions

- Evaluating A Crypto Exchange: Navigating The Complex World Of Digital Assets

- The Rise Of Cryptocurrency In Decentralized Finance A New Era Of Financial Freedom

Imagine a world where banks are no longer the gatekeepers of finance, and individuals have complete control over their money. This isn’t a utopian dream; it’s the reality of Decentralized Finance, commonly referred to as DeFi. Born out of the principles of blockchain and cryptocurrencies, DeFi is redefining the way we think about financial systems, offering a more inclusive, secure, and accessible alternative to traditional banking.

The Early Days: 2009-2014

The journey of DeFi began in 2009 with the launch of Bitcoin, the first decentralized cryptocurrency. Bitcoin’s underlying technology, blockchain, introduced a decentralized ledger that recorded transactions without the need for intermediaries. This innovation sparked a new wave of financial innovation, as developers began to explore the possibilities of decentralized financial systems.

However, it wasn’t until the launch of Ethereum in 2015 that DeFi started to gain momentum. Ethereum’s smart contract functionality allowed developers to build decentralized applications (dApps) that could execute complex transactions and automate various processes. This laid the foundation for the development of more sophisticated DeFi protocols.

The Rise of DeFi: 2017-2020

The launch of MakerDAO in 2017 marked a significant turning point in the development of DeFi. MakerDAO introduced the concept of decentralized lending, allowing users to borrow a stablecoin called DAI using Ethereum as collateral. This decentralized lending protocol demonstrated the potential of DeFi to disrupt traditional financial systems.

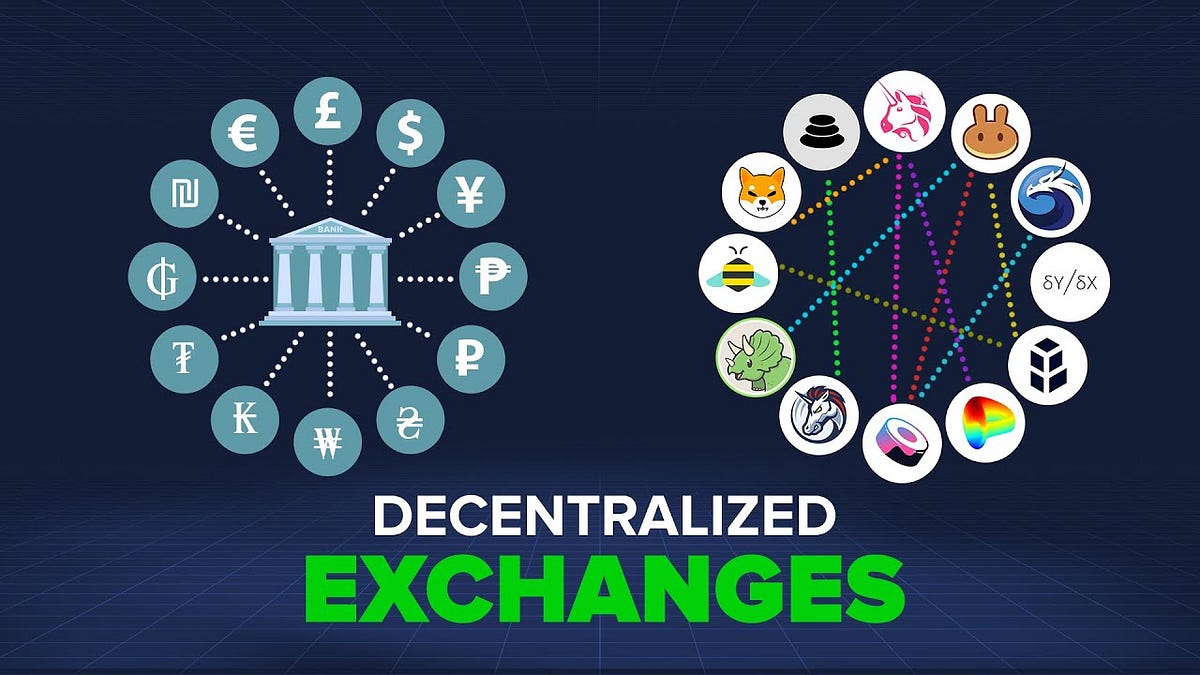

The subsequent launch of decentralized exchanges (DEXs) like Uniswap and SushiSwap further accelerated the growth of DeFi. These platforms enabled users to trade cryptocurrencies without the need for intermediaries, reducing fees and increasing efficiency. The rise of yield farming protocols like Compound and Aave also attracted new users to the DeFi space, offering attractive interest rates on deposits.

The Mainstream Moment: 2020-Present

The COVID-19 pandemic and subsequent global lockdowns accelerated the growth of DeFi, as more people turned to online assets and decentralized systems. The launch of Decentralized Finance 2.0 (DeFi 2.0) protocols like Yearn.finance and Curve further increased the adoption of DeFi.

Today, DeFi has become a mainstream phenomenon, with a cumulative market capitalization exceeding $100 billion. The space has attracted the attention of institutional investors, venture capitalists, and even traditional financial institutions. The likes of Bloomberg, JPMorgan, and Goldman Sachs are now actively exploring DeFi solutions, demonstrating the growing recognition of its potential.

Key Players and Trends

Some key players have played a significant role in shaping the DeFi landscape. Chainlink, a decentralized oracle network, has enabled the creation of hybrid smart contracts that can interact with real-world data. Polygon (formerly Matic Network) has provided a scaling solution for Ethereum, reducing congestion and increasing the adoption of DeFi applications.

The growing popularity of Non-Fungible Tokens (NFTs) has also led to the development of DeFi applications that incorporate NFTs into lending protocols and yield farming strategies. The rise of decentralized identifiers (DIDs) and verifiable credentials will further enhance the security and accessibility of DeFi systems.

The Future of DeFi

As DeFi continues to evolve, we can expect to see new innovations and use cases emerge. The integration of artificial intelligence and machine learning will further enhance the efficiency and security of DeFi systems. The growth of decentralized autonomous organizations (DAOs) will also lead to more community-driven decision-making and governance in the DeFi space.

However, the DeFi space is not without its challenges. Regulatory uncertainty, scalability issues, and security risks remain significant concerns. As DeFi continues to grow, it’s essential for developers, regulators, and users to work together to address these challenges and create a more robust and sustainable financial system.

In conclusion, DeFi has come a long way since its inception, offering a more inclusive, secure, and accessible alternative to traditional financial systems. As the space continues to evolve, it’s essential to stay informed, engaged, and adaptable to the changing landscape. The future of finance is decentralized, and it’s here to stay.