Diversifying Your Portfolio With Crypto Index Funds: A Beginner’s Guide

Diversifying Your Portfolio with Crypto Index Funds: A Beginner’s Guide

- Unlocking The Power Of Passive Income: Top Crypto Projects To Consider

- The Emergence Of Sidechains In Blockchain Unlocking New Possibilities

- The Rise Of Quantum Computing: A Double-Edged Sword For Cryptocurrency Security

- The History Of Bitcoin A Timeline Of Triumph And Turbulence

- Proof Of Work Pow The Backbone Of Secure Networks In The Cryptocurrency Space

Investing in cryptocurrency can be an exciting venture, but it can also be overwhelming, especially for those new to the space. With so many different coins and tokens available, it can be difficult to decide which ones to invest in. One way to simplify the process and minimize risk is by investing in crypto index funds. In this article, we’ll take a closer look at what crypto index funds are, how they work, and how you can use them to gain diversified exposure to the market.

What are Crypto Index Funds?

Crypto index funds are investment vehicles that allow you to buy a small piece of a large portfolio of cryptocurrencies. They’re similar to traditional index funds, which track a specific stock market index, such as the S&P 500. However, instead of stocks, crypto index funds track a specific basket of cryptocurrencies.

How do Crypto Index Funds Work?

Crypto index funds use a variety of methods to track the performance of a specific basket of cryptocurrencies. Some funds use a market-capitalization-weighted approach, where the portfolio is weighted based on the market capitalization of each coin. Other funds use a price-weighted approach, where the portfolio is weighted based on the price of each coin.

Benefits of Investing in Crypto Index Funds

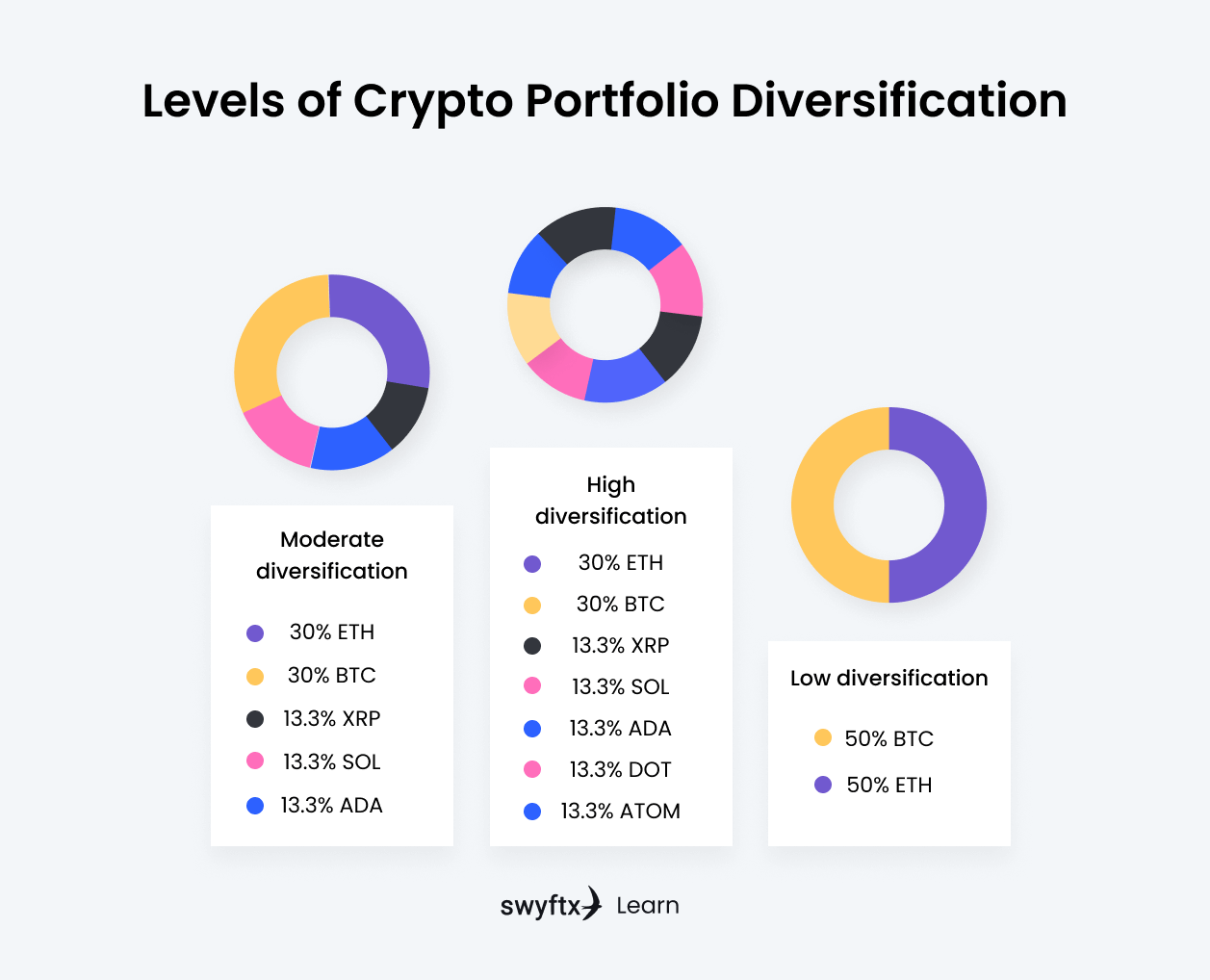

- Diversification: Investing in crypto index funds allows you to gain exposure to a large portfolio of cryptocurrencies, which can help minimize risk and increase potential returns.

- Convenience: Crypto index funds are often easier to manage than a portfolio of individual coins, as they require less research and maintenance.

- Reduced Risk: By investing in a diversified portfolio of cryptocurrencies, you can reduce your risk exposure to any one particular coin.

- Increased Accessibility: Crypto index funds make it easier for new investors to enter the market, as they don’t require extensive knowledge of individual coins.

How to Invest in Crypto Index Funds

- Choose a Reputable Platform: Look for a reputable platform that offers crypto index funds, such as Coinbase, Bitwise, or Grayscale.

- Select Your Fund: Choose the fund that aligns with your investment goals and risk tolerance.

- Fund Your Account: Deposit funds into your account, which can typically be done via wire transfer or credit card.

- Place Your Order: Place an order to buy the selected fund, which can usually be done online or through a mobile app.

Popular Crypto Index Funds to Consider

- Coinbase Index Fund: This fund tracks the performance of the top 10 cryptocurrencies by market capitalization, weighted based on their market capitalization.

- Bitwise 10 Large Cap Crypto Index Fund: This fund tracks the performance of the top 10 cryptocurrencies by market capitalization, weighted based on their market capitalization.

- Grayscale Digital Large Cap Fund: This fund tracks the performance of the top 4 cryptocurrencies by market capitalization, weighted based on their market capitalization.

Investing in crypto index funds can be a great way to gain diversified exposure to the cryptocurrency market. By understanding how these funds work and what benefits they offer, you can make informed investment decisions and increase your potential returns. Remember to always do your research, choose a reputable platform, and invest responsibly.

Disclaimer: Investing in cryptocurrency carries risk, and the value of your investment may fluctuate. It’s essential to do your research, set clear investment goals, and consult with a financial advisor if needed.