Diving Into The World Of Bitcoin: A Straightforward Path To Your First Purchase

Diving into the World of Bitcoin: A Straightforward Path to Your First Purchase

- Evaluating Cryptocurrency Exchanges: A Comprehensive Guide To Safety And Security

- Unraveling The Enigma: Top Crypto Tools For Deciphering Market Sentiment

- The Unsung Heroes Of Global Finance: How Remittances Can Thrive With Crypto Adoption

- The Emergence Of Sidechains In Blockchain Unlocking New Possibilities

- Unlock The Power Of Crypto Staking Pools: A Beginner’s Path To Passive Income

In the realm of cryptocurrencies, bitcoin stands out as a household name, captivating the attention of both seasoned investors and curious newcomers alike. With its growing popularity, buying bitcoin has become more accessible than ever. Whether you’re drawn to the promise of decentralized finance, intrigued by the tech behind it, or simply looking to diversify your investment portfolio, this step-by-step guide is designed to walk you through the process with ease.

Step 1: Understand the Basics

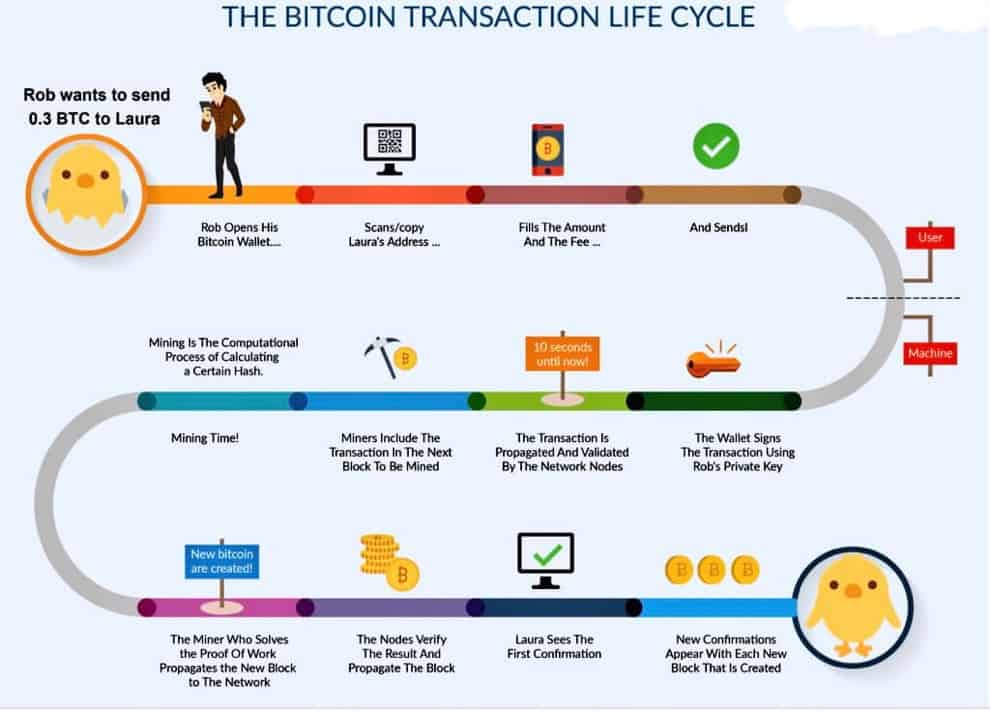

Before you embark on your bitcoin-buying journey, it’s essential to grasp the fundamental aspects of this cryptocurrency. Bitcoin is a digital or virtual currency that uses peer-to-peer technology to facilitate instant payments. It’s decentralized, meaning no government, institution, or central entity controls it. Transactions are recorded on a public ledger called the blockchain, ensuring transparency and security.

Step 2: Choose Your Bitcoin Exchange

The next step involves finding a reliable bitcoin exchange that suits your needs. Exchanges are platforms where you can trade traditional currencies for cryptocurrencies like bitcoin. Some popular exchanges include Coinbase, Binance, and Kraken. When choosing an exchange, consider factors such as:

- Security and Reputation: Look for exchanges with robust security measures and a strong track record.

- Fees: Check the fees associated with buying and selling on the exchange.

- User Experience: Opt for an exchange with an intuitive interface that makes navigation easy.

- Compliance: Ensure the exchange complies with regulatory requirements in your region.

Step 3: Set Up Your Bitcoin Wallet

A bitcoin wallet is where you’ll store your purchased bitcoin. Wallets come in various forms, including:

- Software Wallets: These apps are installed on your computer or mobile device.

- Hardware Wallets: These are physical devices specifically designed to store cryptocurrencies securely.

- Web Wallets: These are cloud-based wallets accessible through the internet.

Choose a wallet that aligns with your level of comfort and security expectations. Some exchanges offer a built-in wallet for added convenience.

Step 4: Verify Your Identity

To comply with anti-money laundering (AML) and know-your-customer (KYC) regulations, you’ll need to verify your identity on the exchange. This typically involves uploading a valid photo ID and proof of address. This step might seem daunting, but it’s a critical piece of the puzzle in ensuring the legitimacy of the exchange and protecting your financial safety.

Step 5: Fund Your Exchange Account

With your identity verified, you’ll need to fund your exchange account. Different exchanges support various payment methods, including:

- Credit/Debit Cards: Convenient but often with higher fees.

- Bank Transfers: Cost-effective but may take longer to process.

- Other Payment Options: Some exchanges accept alternative payment methods like e-wallets or cryptocurrencies.

Step 6: Purchase Your Bitcoin