Embracing The Decentralized Finance Revolution: Unlocking Profits In DeFi Lending And Borrowing Platforms

Embracing the Decentralized Finance Revolution: Unlocking Profits in DeFi Lending and Borrowing Platforms

- The Dark Side Of Luxury: How Blockchain Is Fighting Counterfeit Goods

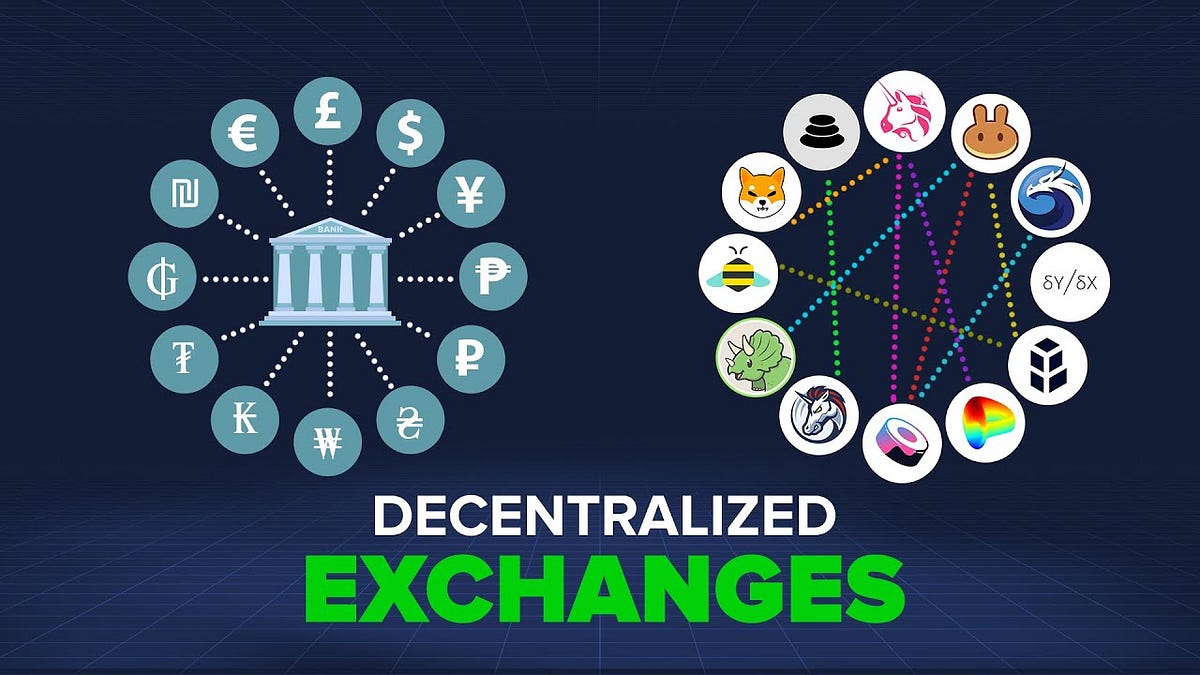

- Embracing The Freedom Of Anonymity In Crypto Trading: A Beginner’s Guide To Decentralized Exchanges

- Embarking On A Crypto Investing Adventure: A Beginner’s Guide To Navigating The Wild West Of Digital Currencies

- The Rise Of Cryptocurrency In Decentralized Finance A New Era Of Financial Freedom

- The Democratization Of Lending: How Crypto Is Revolutionizing Peer-to-Peer Finance

The world of finance is evolving rapidly, and the emergence of Decentralized Finance (DeFi) is transforming the way we think about lending and borrowing. DeFi lending and borrowing platforms have gained immense popularity in recent years, offering a new way for individuals to access financial services without the need for traditional intermediaries. As the DeFi space continues to grow, it’s essential to understand how to navigate these platforms and unlock potential profits.

Understanding the Basics of DeFi Lending and Borrowing

DeFi lending and borrowing platforms use blockchain technology to facilitate peer-to-peer transactions, allowing individuals to lend and borrow cryptocurrencies. These platforms typically operate on smart contracts, which are self-executing and automate the lending and borrowing process. Lenders deposit their cryptocurrencies into a liquidity pool, which is then used to fund borrowers. In return, lenders receive interest on their deposits, while borrowers can access the funds they need to invest or cover expenses.

How to Profit from DeFi Lending

DeFi lending can be a lucrative way to earn passive income, especially for those holding cryptocurrencies with low volatility. Here are some strategies to profit from DeFi lending:

- Choose the right platform: Research and select a reputable DeFi lending platform that offers competitive interest rates and low fees. Look for platforms with a strong track record of security and a transparent lending process.

- Diversify your portfolio: Spread your investments across multiple DeFi lending platforms to minimize risk. This will help you avoid exposure to any single platform or market volatility.

- Select the right assets: Lend cryptocurrencies with low volatility and high demand, such as stablecoins or established cryptocurrencies like Bitcoin or Ethereum.

- Monitor and adjust: Keep a close eye on market conditions and adjust your lending strategy as needed. This may involve shifting your investments to different platforms or assets.

How to Profit from DeFi Borrowing

DeFi borrowing can be an attractive option for individuals looking to access funds for investments or to cover expenses. Here are some strategies to profit from DeFi borrowing:

- Use borrowed funds for investments: Borrow funds to invest in other DeFi platforms or cryptocurrencies with high growth potential. This can help you leverage your investments and increase returns.

- Take advantage of low-interest rates: Borrow funds at low-interest rates to cover expenses or invest in opportunities with higher returns.

- Choose the right asset: Borrow assets with low volatility and high liquidity, making it easier to repay the loan.

- Repay loans efficiently: Repay loans quickly to minimize interest payments and avoid liquidation.

Managing Risk in DeFi Lending and Borrowing

While DeFi lending and borrowing can be lucrative, it’s essential to manage risk to avoid losses. Here are some tips to mitigate risk:

- Understand the platform’s risk management: Research the platform’s risk management strategy, including its approach to liquidation and collateral.

- Set clear investment goals: Establish clear investment goals and risk tolerance to guide your lending and borrowing decisions.

- Diversify your portfolio: Spread your investments across multiple DeFi lending and borrowing platforms to minimize exposure to any single platform or market volatility.

- Monitor and adjust: Continuously monitor market conditions and adjust your lending and borrowing strategy as needed.

DeFi lending and borrowing platforms offer a new way for individuals to access financial services and unlock profits. By understanding the basics of DeFi lending and borrowing, choosing the right platforms and assets, and managing risk, you can navigate the DeFi space and achieve your financial goals. As the DeFi space continues to evolve, it’s essential to stay informed and adapt to changing market conditions.