Embracing The Future Of Payments: A Step-by-Step Guide To Setting Up A Crypto Payment Processor For Your Business

Embracing the Future of Payments: A Step-by-Step Guide to Setting Up a Crypto Payment Processor for Your Business

- How To Use Nfts For Digital Art And Collectibles

- Cryptocurrency Yield Farming 101: Unlocking Passive Income Opportunities

- The Lucrative World Of DeFi Lending: How To Profit From The Latest Fintech Revolution

- Navigating Turbulent Tides: Strategies For Safeguarding Your Crypto Investments

- The Benefits Of Using Crypto For Microtransactions

As the world of cryptocurrency continues to grow and gain mainstream acceptance, more and more businesses are starting to take notice of the benefits that come with integrating crypto payments into their operations. Not only can it help to attract a new wave of customers, but it can also provide a more secure and efficient way of processing transactions.

In this article, we’ll take a closer look at the process of setting up a crypto payment processor for your business, and what you need to know to get started.

What is a Crypto Payment Processor?

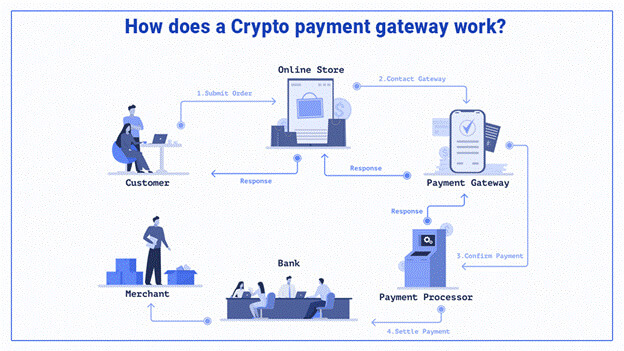

A crypto payment processor is a platform that allows your business to accept cryptocurrency payments from customers. This can include a variety of different cryptocurrencies, such as Bitcoin, Ethereum, and Litecoin, among others. The processor acts as an intermediary between your business and the customer, handling the exchange of cryptocurrency for traditional fiat currency.

Benefits of Using a Crypto Payment Processor

So, why should your business consider using a crypto payment processor? Here are just a few of the benefits:

- Increased Security: Crypto payments are recorded on a public ledger called a blockchain, which makes them virtually impossible to hack or manipulate.

- Lower Transaction Fees: Compared to traditional payment processors, crypto payment processors often charge lower transaction fees.

- Faster Transaction Times: Crypto payments are often processed in real-time, eliminating the need for lengthy payment processing times.

- Access to a New Market: By accepting crypto payments, you can tap into a growing market of customers who prefer to use cryptocurrency.

How to Set Up a Crypto Payment Processor

Now that we’ve covered the benefits of using a crypto payment processor, let’s take a look at the steps you need to take to set one up for your business:

- Choose a Crypto Payment Processor: There are a number of different crypto payment processors to choose from, including Coinbase, BitPay, and BlockchainPay, among others. When choosing a processor, consider factors such as fees, security, and customer support.

- Create an Account: Once you’ve chosen a processor, create an account and provide the required information, such as your business name and address.

- Set Up Your Wallet: Next, you’ll need to set up a crypto wallet to store your cryptocurrency funds. This can be done through the processor’s platform or a third-party wallet provider.

- Integrate the Processor into Your Website: To start accepting crypto payments, you’ll need to integrate the processor into your website. This can be done using an API or plugin, depending on the processor and your website platform.

- Test the Processor: Before you start accepting crypto payments, make sure to test the processor to ensure that it’s working properly.

Popular Crypto Payment Processors

Here are a few of the most popular crypto payment processors:

- Coinbase: Coinbase is one of the most well-known crypto payment processors, with a user-friendly interface and competitive fees.

- BitPay: BitPay is another popular processor, with a strong focus on security and customer support.

- BlockchainPay: BlockchainPay is a processor that specializes in cryptocurrency payments, with a range of features and integrations.

Tips and Tricks