How Decentralized Finance Defi Is Changing The Financial Industry

Imagine a world where financial transactions are faster, cheaper, and more secure. A world where anyone with an internet connection can access financial services, without the need for intermediaries like banks or governments. This world is becoming a reality, thanks to the rise of decentralized finance, or DeFi.

- Navigating Turbulent Tides: Strategies For Safeguarding Your Crypto Investments

- Top Altcoins To Watch In 2024

- Safeguarding Personal Data In The Digital Age

- What Are Flash Loans In Defi And How Do They Work

- The New Guardian Of Patient Data: How Blockchain Is Revolutionizing Healthcare Security

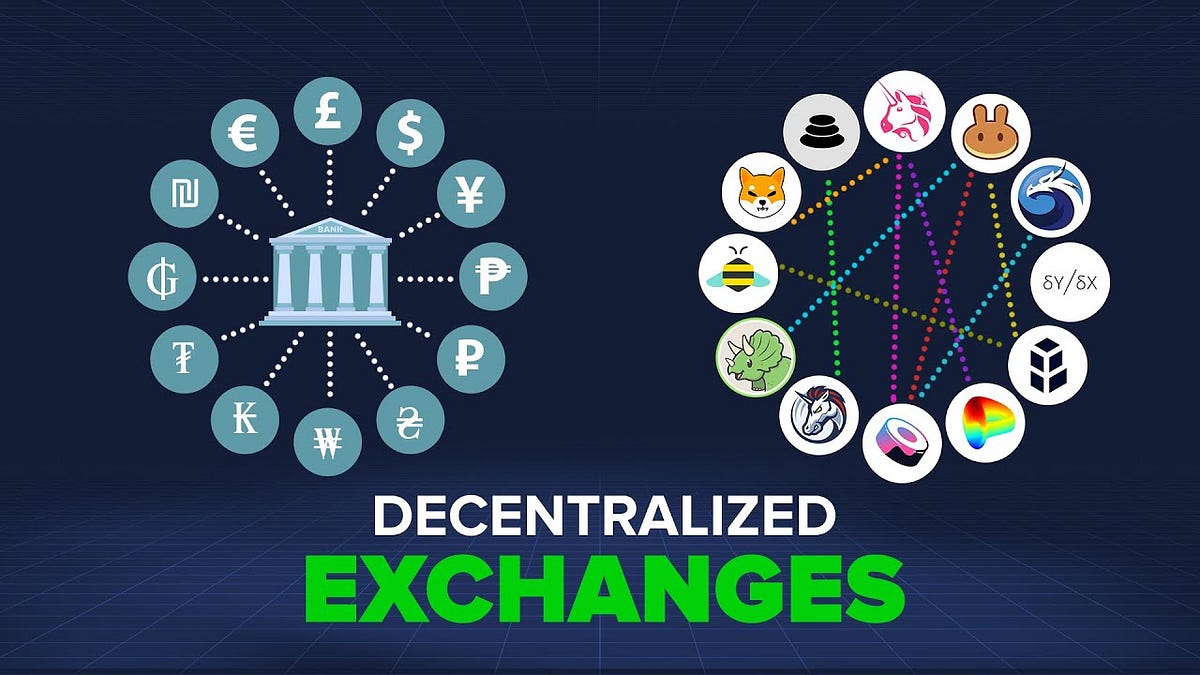

DeFi is a term used to describe a set of financial services and systems that operate on blockchain technology, rather than through traditional financial institutions. Blockchain technology allows for secure, transparent, and tamper-proof transactions, without the need for intermediaries. This is in stark contrast to the traditional financial system, where transactions are often slow, expensive, and reliant on intermediaries like banks and payment processors.

One of the key advantages of DeFi is its ability to provide financial services to the unbanked and underbanked. According to a report by the World Bank, there are currently 1.7 billion adults worldwide who lack access to basic financial services. DeFi platforms are helping to address this issue, by providing access to financial services like lending, borrowing, and savings, to anyone with an internet connection.

DeFi is also changing the way that financial transactions are made. Traditional financial transactions often rely on a central authority, like a bank or payment processor, to verify and settle transactions. This can lead to delays and increased costs. DeFi platforms, on the other hand, use smart contracts and blockchain technology to facilitate transactions, which are often faster and cheaper.

Another area where DeFi is having a major impact is in the field of lending. Traditional lending models often rely on credit scores and other forms of credit assessment, which can be time-consuming and expensive. DeFi platforms are using blockchain technology to create decentralized lending models, which are often more accessible and affordable.

DeFi is also providing new opportunities for investors. Traditional investment options are often limited to stocks, bonds, and real estate. DeFi platforms are providing access to new investment opportunities, like lending, borrowing, and trading, which can be more lucrative and flexible.

However, DeFi is not without its risks. One of the main risks is regulatory uncertainty. Many governments and regulatory bodies are still grappling with how to regulate DeFi, which can create uncertainty and risk for investors. Another risk is the volatility of cryptocurrency prices, which can create uncertainty and risk for investors.

Despite these risks, DeFi is having a major impact on the financial industry. According to a report by Deloitte, the DeFi market is expected to grow to $1 trillion by 2025. This growth is being driven by increasing adoption and investment in DeFi platforms, as well as the development of new use cases and applications.

In conclusion, DeFi is changing the financial industry in profound ways. By providing faster, cheaper, and more secure financial transactions, DeFi is making financial services more accessible and inclusive. DeFi is also providing new opportunities for investors and changing the way that financial transactions are made. While there are risks and uncertainties associated with DeFi, the benefits and potential of this technology make it an exciting and important development in the financial industry.

DeFi is also enabling a new generation of financial innovators to create new products and services, which can be tailored to specific customer needs. This is creating new opportunities for financial inclusion and is helping to address some of the biggest challenges facing the financial industry today.

The shift to DeFi is also being driven by increasing demand for more efficient, secure, and transparent financial systems. Traditional financial systems can be slow, cumbersome, and vulnerable to cyber attacks. DeFi platforms, on the other hand, are designed to be secure, fast, and transparent, making them more attractive to investors and financial institutions.

In the future, we can expect DeFi to continue to evolve and improve, with new technologies and innovations emerging all the time. This is likely to have a profound impact on the financial industry, making financial services more accessible, inclusive, and efficient. Whether you’re a seasoned investor or just starting out, DeFi is definitely worth keeping an eye on.