Pump And Dump Schemes: The Dark Side Of Cryptocurrency Investing

Pump and Dump Schemes: The Dark Side of Cryptocurrency Investing

- Unlocking The Power Of Decentralized Finance: A Beginner’s Guide To Profiting From DeFi Lending And Borrowing Protocols

- Unique NFTs And Digital Content – A New Era Of Monetization

- Breaking Down Barriers: How Unique Blockchain Technology Can Unlock Financial Inclusion For The Unbanked

- Wrapped Tokens: Unraveling The Mystery Behind This Crypto Phenomenon

- Crypto Dust Attacks On The Rise – A Growing Threat To Your Digital Assets

As the world of cryptocurrency becomes increasingly mainstream, investors are eager to jump on the bandwagon and make some serious profits. However, with great reward comes great risk, and one of the most significant threats to investors is the pump and dump scheme. In this article, we’ll delve into the world of pump and dump schemes, explore how they work, and provide you with some valuable tips on how to stay safe in the world of cryptocurrencies.

What is a Pump and Dump Scheme?

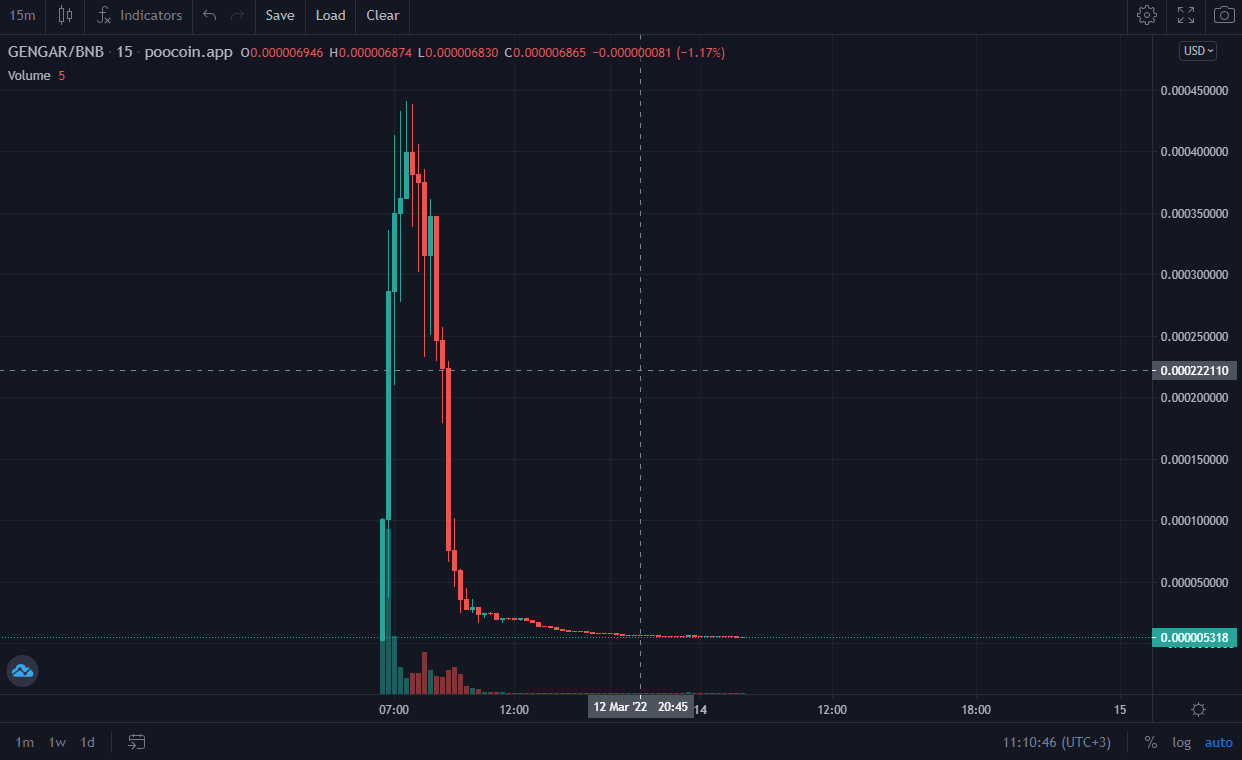

A pump and dump scheme is a type of scam that involves artificially inflating the price of a cryptocurrency, only to sell it off at a profit when the price reaches its peak. This is often done by a group of individuals who coordinate their efforts to promote a particular cryptocurrency, creating a false narrative about its potential for growth and adoption.

The scheme usually starts with a small group of individuals who buy up a large quantity of a relatively unknown cryptocurrency at a low price. They then proceed to promote the cryptocurrency on social media, online forums, and other platforms, creating a buzz around its potential for growth. As more and more people start to take notice of the cryptocurrency, its price begins to rise, making it an attractive investment opportunity for unsuspecting investors.

Once the price reaches a certain threshold, the group who orchestrated the scheme will sell off their holdings, causing the price to plummet and leaving the unsuspecting investors with significant losses.

Signs of a Pump and Dump Scheme

So, how can you spot a pump and dump scheme in the making? Here are some common signs to look out for:

- Unsolicited Promotion: If you receive unsolicited messages or emails promoting a particular cryptocurrency, it may be a sign that a pump and dump scheme is underway.

- Over-the-Top Marketing: Be wary of over-the-top marketing tactics, such as exaggerated claims about the cryptocurrency’s potential for growth or adoption.

- Unusual Trading Patterns: Keep an eye out for unusual trading patterns, such as a sudden surge in price followed by a rapid decline.

- Lack of Transparency: If the individuals promoting the cryptocurrency are unclear about their motivations or the project’s development, it may be a sign of a pump and dump scheme.

How to Avoid Pump and Dump Schemes

So, how can you avoid falling victim to a pump and dump scheme? Here are some valuable tips to keep in mind:

- Do Your Research: Before investing in any cryptocurrency, make sure to do your research. Look for independent reviews and analysis, and be wary of biased or promotional content.

- Verify the Source: Always verify the source of the information you’re receiving. Be wary of unsolicited messages or emails, and make sure to research the individual or organization promoting the cryptocurrency.

- Don’t Fall for the Hype: Be cautious of over-the-top marketing tactics, and don’t fall for the hype surrounding a particular cryptocurrency. Make sure to evaluate its potential for growth and adoption based on solid evidence and facts.

- Use Reputable Exchanges: Make sure to use reputable exchanges and trading platforms. Look for exchanges that have a strong track record of security and transparency.

- Don’t Invest More Than You Can Afford to Lose: Finally, never invest more than you can afford to lose. Cryptocurrency investing is inherently risky, and you should always be prepared for the worst-case scenario.

Pump and dump schemes are a significant threat to investors in the world of cryptocurrencies. However, by being aware of the signs of a pump and dump scheme and taking steps to avoid them, you can significantly reduce your risk of falling victim to these scams. Remember to always do your research, verify the source of the information you’re receiving, and never invest more than you can afford to lose. By following these tips, you can stay safe in the world of cryptocurrencies and avoid falling victim to pump and dump schemes.