Spreading Your Bets: A Beginner’s Guide To Crypto Index Funds

Spreading Your Bets: A Beginner’s Guide to Crypto Index Funds

- What Are Oracles In Blockchain And How Do They Work

- Navigating Turbulent Tides: Strategies For Safeguarding Your Crypto Investments

- The Best Crypto Staking Platforms For Passive Income

- Liquidity’s Crucial Role In Shaping The Fate Of Cryptocurrency Markets

- Unlocking The Power Of Secure Identity Verification: The Cryptocurrency Revolution

If you’re new to the world of cryptocurrency, the thought of navigating the often-turbulent waters of Bitcoin, Ethereum, and their ilk can be daunting. But what if you could get in on the ground floor of the crypto revolution without having to be a full-time trader or investment expert? Enter crypto index funds, a type of investment vehicle that allows you to own a small piece of the entire crypto market with just a single investment.

What are Crypto Index Funds?

In traditional investing, index funds track a specific market index, such as the S&P 500 or the Dow Jones Industrial Average. Crypto index funds work similarly, but instead of following the performance of big-name stocks, they track the performance of a basket of cryptocurrencies. By investing in a crypto index fund, you’re essentially buying a small piece of the entire crypto market, which can provide instant diversification and reduce your exposure to any one particular coin.

Benefits of Crypto Index Funds

So why should you consider investing in a crypto index fund? Here are just a few benefits:

- Diversification: By owning a small piece of the entire crypto market, you’re spreading your bets and reducing your exposure to any one particular coin. This can help minimize losses if one or two coins experience a downturn.

- Convenience: Investing in a crypto index fund is often easier than buying and trading individual cryptocurrencies. You can typically invest with a single click, and many funds offer automatic rebalancing to ensure your portfolio remains aligned with the underlying index.

- Low Maintenance: Unlike actively managed funds, which require constant monitoring and maintenance, crypto index funds are designed to be set-it-and-forget-it investments. Once you’ve invested, you can sit back and let the fund do the work for you.

- Low Fees: Crypto index funds often have lower fees than actively managed funds, which can help you keep more of your hard-earned cash.

How to Get Started

Investing in a crypto index fund is relatively straightforward. Here are the basic steps:

- Choose a fund: Look for a reputable fund with a proven track record and a diverse portfolio of cryptocurrencies. Some popular options include Bitwise, Grayscale, and CryptoIndex.

- Set your budget: Determine how much you want to invest in the fund, taking into account your overall financial goals and risk tolerance.

- Fund your account: Deposit the required amount into your account, which can typically be done via wire transfer or credit card.

- Invest: Click the "invest" button to purchase shares in the fund.

- Monitor and rebalance: While crypto index funds are designed to be low-maintenance, it’s still important to keep an eye on your investment and rebalance as needed to ensure it remains aligned with your goals.

Risks and Considerations

As with any investment, there are risks associated with investing in crypto index funds. Here are a few things to keep in mind:

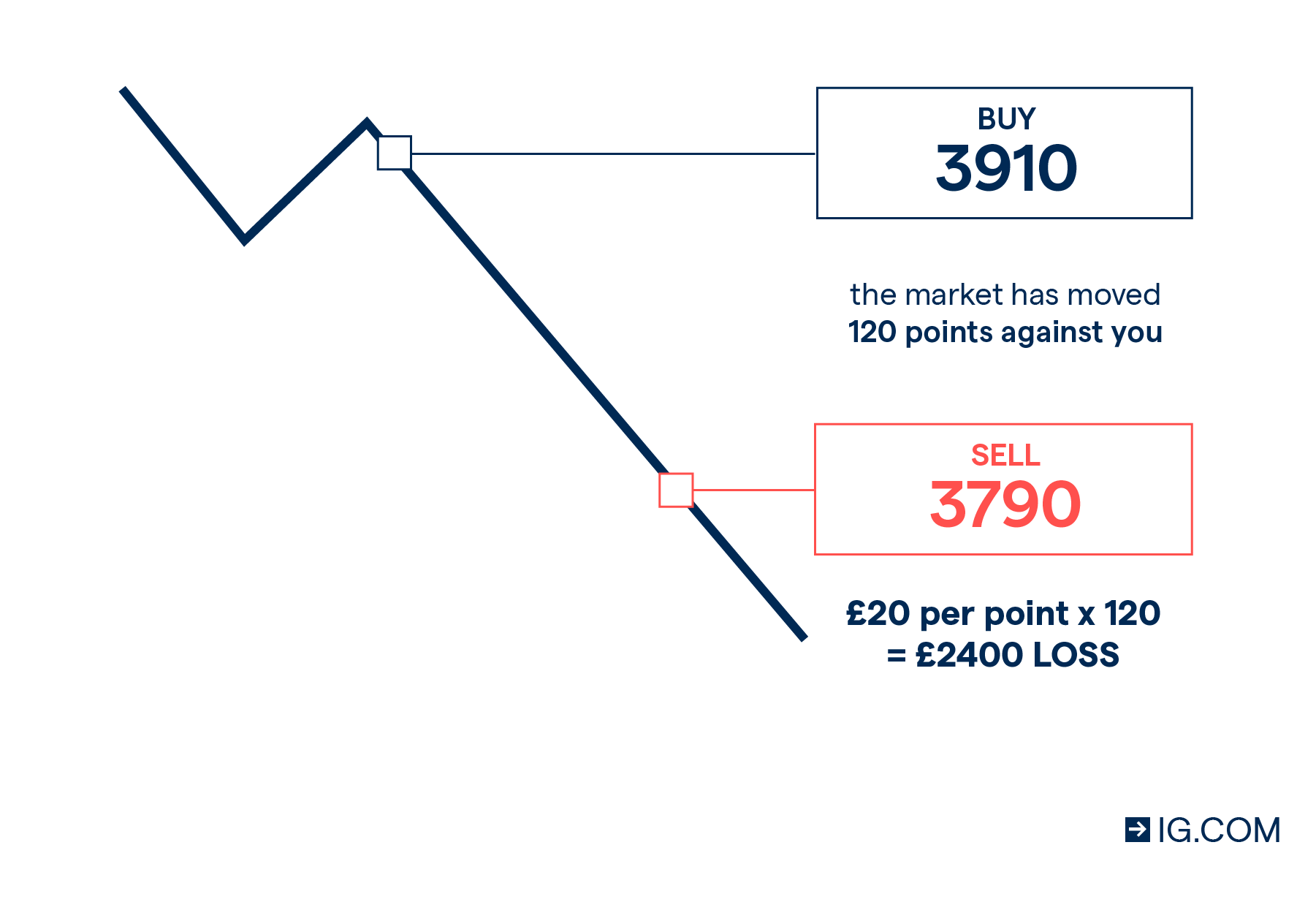

- Market volatility: Cryptocurrency markets can be notoriously volatile, with prices fluctuating rapidly and unpredictably.

- Lack of regulation: The cryptocurrency market is still largely unregulated, which can make it difficult to know what you’re getting into.

- Security risks: As with any investment, there are security risks associated with investing in crypto index funds, including the potential for hacking and theft.

Investing in crypto index funds can be a great way to get in on the ground floor of the crypto revolution without having to be a full-time trader or investment expert. By spreading your bets and reducing your exposure to any one particular coin, you can minimize losses and maximize gains. Just remember to do your research, set a budget, and keep an eye on your investment to ensure it remains aligned with your goals. Happy investing!