The Future Of Blockchain In Decentralized Finance Defi

Imagine a world where financial transactions are faster, cheaper, and more transparent. A world where anyone with an internet connection can access financial services, regardless of their geographical location or economic status. This is the world of decentralized finance, or DeFi, and blockchain technology is at its core.

- What Is A Dao And How Can You Participate

- The Future Of Blockchain In Digital Identity And Privacy

- What Are Stablecoins And How Do They Work

- Revealing The Power Of Anonymity Enhancing Blockchain Privacy With Zero Knowledge Proofs

- Blockchain Revolutionizes Supply Chain Transparency: How This Tech Breakthrough Is Changing The Game

In recent years, DeFi has experienced explosive growth, with the total value locked (TVL) in DeFi protocols increasing from just over $1 billion in 2020 to over $100 billion today. But what exactly is DeFi, and how is blockchain technology driving its growth?

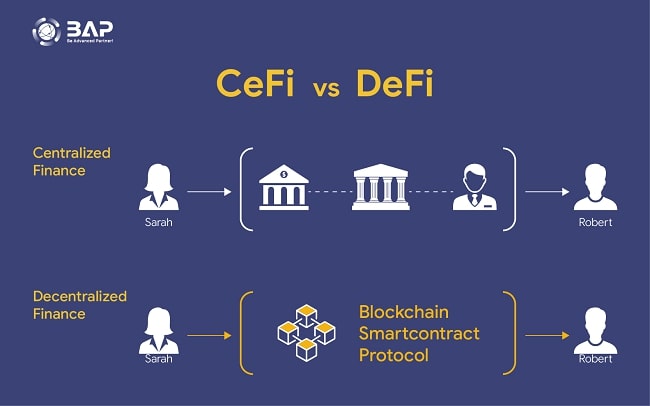

At its simplest, DeFi refers to a set of financial services that operate on blockchain networks, rather than through traditional financial institutions. This can include everything from lending and borrowing to trading and investing. Because DeFi protocols are built on blockchain technology, they are able to operate in a decentralized manner, without the need for intermediaries like banks or brokerages.

One of the key advantages of DeFi is its ability to provide financial services to individuals who may not have had access to them in the past. In traditional finance, accessing services like loans or credit can be difficult and expensive, especially for those in developing countries. But with DeFi, anyone with an internet connection can access a range of financial services, regardless of their location or economic status.

But DeFi is not just about providing financial services to underserved populations. It’s also about creating a more efficient and transparent financial system. Because DeFi protocols are built on blockchain technology, all transactions are recorded on a public ledger, making them transparent and tamper-proof. This reduces the risk of fraud and error, and increases trust in the financial system as a whole.

So, what does the future hold for DeFi and blockchain? One area that’s likely to see significant growth is decentralized lending. Traditional lending often requires collateral and a good credit score, which can be a barrier for many people. But with DeFi, lending protocols are able to use smart contracts and blockchain technology to create more equitable and accessible lending systems.

Another area that’s likely to see growth is decentralized exchanges, or DEXs. Traditional exchanges often require intermediaries like brokers or banks, which can increase costs and reduce transparency. But DEXs are able to operate in a decentralized manner, allowing users to buy and sell assets directly with one another.

As DeFi continues to grow and evolve, we can expect to see more innovations in areas like decentralized governance, or DAOs. A DAO is essentially a community-driven organization that operates on a blockchain network, allowing members to make decisions and vote on proposals in a decentralized manner.

In terms of the technology itself, we can expect to see significant advancements in areas like scalability and usability. One of the biggest challenges facing DeFi today is scalability, with many protocols struggling to handle high volumes of transactions. But with the development of new technologies like layer 2 scaling solutions and sharding, we can expect to see DeFi protocols become more efficient and effective.

Finally, as DeFi continues to grow and mature, we can expect to see more regulatory clarity around the space. While DeFi is often associated with cryptocurrency and the Wild West of finance, many DeFi protocols are already working closely with regulators to ensure compliance and build trust in the industry.

In conclusion, the future of DeFi and blockchain is bright. As the technology continues to evolve and mature, we can expect to see more innovations in areas like decentralized lending, DEXs, and DAOs. With its potential to create a more efficient, transparent, and equitable financial system, DeFi is poised to revolutionize the way we think about finance.