The Impact Of Decentralized Finance Defi On Traditional Banks

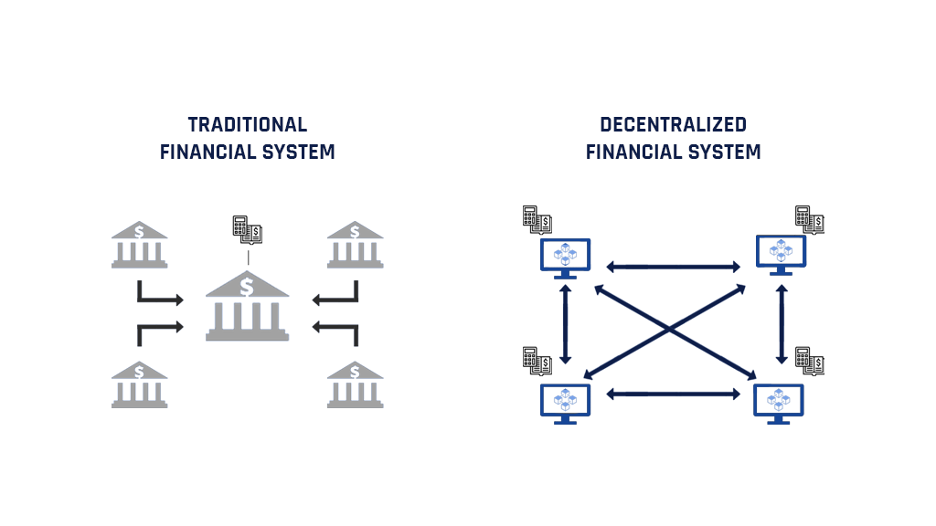

Decentralized finance, or DeFi, has been gaining traction in recent years, and its impact on traditional banks is undeniable. As the world becomes increasingly digital, the concept of traditional banking is being disrupted by this new player in the financial industry. But what exactly is DeFi, and how is it changing the game for traditional banks?

- How To Profit From Crypto Scalping Strategies

- Strengthening The Foundations Of Crypto Security A Guide To Safeguarding Your Blockchain Transactions

- Trading With Fire: How To Leverage Your Cryptocurrency Trades

- Evaluating A Crypto Exchange: Navigating The Complex World Of Digital Assets

- Protecting Your Digital Gold: A Comprehensive Guide To Safely Storing Your Cryptocurrency Wallets

Imagine a world where you can access financial services without having to rely on a bank. A world where you can borrow, lend, and trade assets without the need for intermediaries. This is the world that DeFi is creating. By leveraging blockchain technology and cryptocurrencies, DeFi platforms are providing users with a new way to manage their finances.

For traditional banks, the rise of DeFi is a wake-up call. They are no longer the only players in town, and they need to adapt to this new reality. One of the biggest threats that DeFi poses to traditional banks is disintermediation. By cutting out the middleman, DeFi platforms are able to offer lower fees and faster transaction times, making them a more attractive option for consumers.

Another challenge that traditional banks face in the era of DeFi is the lack of transparency and trust. DeFi platforms are built on blockchain technology, which provides a transparent and secure way to conduct transactions. This transparency is a major draw for users who are fed up with the lack of transparency in traditional banking. By contrast, traditional banks have been criticized for their lack of transparency and accountability, which has led to widespread mistrust.

In addition to disintermediation and lack of transparency, traditional banks are also facing challenges in terms of innovation. DeFi platforms are built on open-source code, which allows developers to build new financial products and services on top of existing ones. This has created a vibrant ecosystem of innovation in the DeFi space, with new products and services emerging all the time.

In contrast, traditional banks have been slow to innovate. They are often hampered by outdated legacy systems and a culture that is resistant to change. This makes it difficult for them to keep up with the pace of innovation in the DeFi space, and they risk being left behind.

So, what does the future hold for traditional banks in the era of DeFi? While some may predict the demise of traditional banks, it is unlikely that they will disappear completely. Instead, they will likely adapt to the new landscape and explore ways to integrate DeFi into their existing offerings.

One way that traditional banks can do this is by partnering with DeFi platforms. By working together, they can leverage the strengths of both worlds and create new financial products and services that meet the needs of consumers. For example, they could use DeFi platforms to offer lending services to customers who do not have access to traditional banking facilities.

Another way that traditional banks can adapt to the era of DeFi is by investing in their own DeFi platforms. This would allow them to offer DeFi services to their customers, while also providing a new revenue stream. By investing in DeFi, traditional banks can future-proof themselves and stay ahead of the competition.

In conclusion, the rise of DeFi is a game-changer for traditional banks. While it poses challenges in terms of disintermediation, lack of transparency, and innovation, it also presents opportunities for them to adapt and evolve. By partnering with DeFi platforms and investing in their own DeFi offerings, traditional banks can stay ahead of the curve and thrive in the new financial landscape.

In the future, we can expect to see even more disruption to the traditional banking industry. As the DeFi space continues to evolve, we will see new innovations and new challenges emerge. But one thing is certain – the future of finance will be decentralized, and traditional banks will need to adapt to survive.

DeFi has shown that financial services do not need to be controlled by a select few but instead can be decentralized and placed in the hands of the people. The users now have the power, thanks to DeFi, and this newfound power will drive further change, giving way to a new economy where borders and boundaries disappear.