Unlocking The Secret To Hands-Free Investing: Crypto Trading Bots

Unlocking the Secret to Hands-Free Investing: Crypto Trading Bots

- Ditch The Cards: Using Cryptocurrency In Your Daily Life

- Navigating The Wild West Of Crypto Trading: A Beginner’s Guide To Safe Trading With Stop Loss Orders

- The Evolution Of Financial Discretion Unraveling The Mystery Of Privacy Coins

- Welcome To The World Of DeFi: Your Step-by-Step Guide To Unlocking Its Potential

- Unlocking The Power Of Secure Identity Verification: The Cryptocurrency Revolution

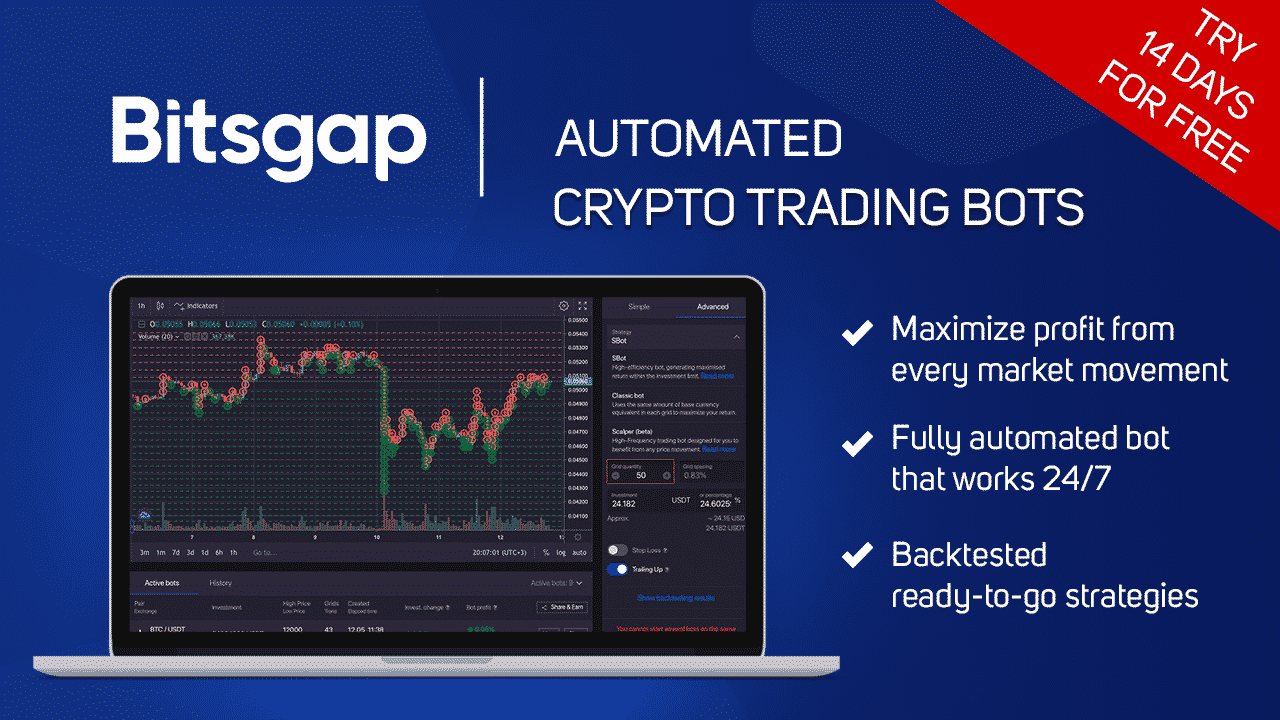

Are you tired of manually monitoring the fluctuating cryptocurrency market around the clock, making trades, and risking sleep deprivation? The answer lies in crypto trading bots – automated programs that execute trades on your behalf, even while you’re catching Z’s. In this article, we’ll delve into the world of trading bots, exploring their benefits, types, and how to get started with these clever tools.

What are Crypto Trading Bots?

A crypto trading bot is a piece of software that leverages programming and algorithms to analyze market trends and make trades based on your predetermined parameters. They act as intermediaries between you and your exchange, automating the trading process and granting you the flexibility to set buy and sell orders, manage risk, and track performance.

Benefits of Trading Bots

- Reducing Emotional Trading: We’re human, and emotions often cloud our judgment. Trading bots eliminate the emotional factor, sticking to your strategy and making data-driven decisions.

- Enhancing Efficiency: By automating trades, you save time and can focus on other activities while your bot works tirelessly in the background.

- Increasing Trading Volume: Trading bots can execute trades at speeds impossible for human traders, enabling you to capitalize on even the smallest market movements.

- Minimizing Risk: By using stop-loss orders and other risk management strategies, trading bots help mitigate potential losses and protect your portfolio.

Types of Trading Bots

- Trend Following Bots: These bots identify market trends and follow them, buying or selling assets as the trend gains momentum.

- Mean Reversion Bots: These bots bet on price reversion to mean, buying low and selling high when the market deviates from its historical average.

- Arbitrage Bots: These bots exploit price differences across exchanges, buying at a low price on one exchange and selling at a higher price on another.

How to Get Started with Trading Bots

- Choose a Compatible Exchange: Not all exchanges support trading bots. Research and select an exchange that integrates with your chosen bot.

- Select a Bot Type: Consider your trading strategy, risk tolerance, and market goals when choosing a bot type.

- Customize Your Bot: Adjust parameters, such as buy and sell signals, risk management settings, and take profit targets.

- Monitor and Refine: Keep a close eye on your bot’s performance, adjusting parameters as needed to optimize results.

Popular Trading Bots

- Gunbot: A feature-rich bot with customizable parameters and support for multiple exchanges.

- Gekko: A popular, open-source bot suitable for both beginners and experienced traders.

- Zenbot: A high-frequency trading bot that executes trades based on technical analysis.