What Are Cross Chain Bridges And How Do They Work

Imagine a world where different blockchain networks can seamlessly communicate with each other, allowing for the free flow of assets and data between them. Sounds like a utopia, right? Well, this world is becoming a reality, thanks to the emergence of cross-chain bridges.

- Unlocking DeFi’s Full Potential: A Step-by-Step Guide To Maximizing Investment Opportunities With Aggregators

- The Future Of Real Estate: How Tokenized Assets Are Revolutionizing The Industry

- What Are Stablecoins And How Do They Work

- How Does Ethereum 2 0 Differ From Ethereum 1 0

- Unlocking The Code: Mastering Technical Analysis In Crypto Trading

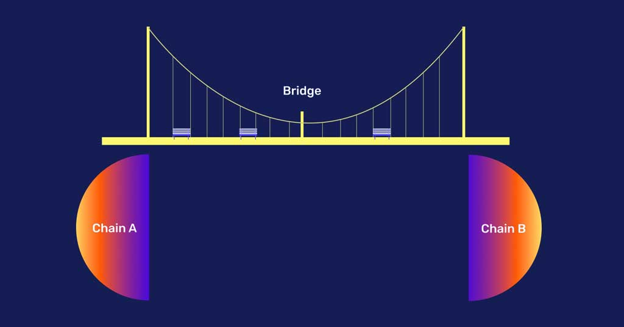

In simple terms, cross-chain bridges are a class of technologies that enable the transfer of assets, data, or information between different blockchain networks. They act as a conduit, allowing various blockchains to "talk" to each other, and facilitating interoperability between them.

To grasp the concept of cross-chain bridges, let’s first understand why they’re needed in the first place. You see, each blockchain network has its own unique architecture, consensus mechanism, and rules. This isolation makes it difficult for different blockchains to interact with each other directly. It’s like trying to connect two devices with different operating systems – they just don’t speak the same language.

This is where cross-chain bridges come in. They’re essentially adaptors that translate the language of one blockchain into another, enabling seamless communication between them. By doing so, they unlock a world of new possibilities, such as:

- Seamless token transfers: With cross-chain bridges, users can transfer tokens between different blockchain networks, without the need for intermediate steps or third-party services.

- Interoperability: Cross-chain bridges enable various blockchain networks to share data, assets, or even Smart Contracts, facilitating collaboration and innovation.

- Liquidity: By connecting multiple blockchain networks, cross-chain bridges can increase liquidity, making it easier for users to buy, sell, or trade assets.

Now, let’s dive into how cross-chain bridges work. There are several architectures, but most of them involve the following key components:

- Locking and Minting: When a user wants to transfer an asset from one blockchain to another, the cross-chain bridge locks the asset on the originating blockchain and mints a corresponding asset on the destination blockchain.

- Verification: The transaction is then verified on both blockchains, ensuring that the asset has been successfully transferred.

- Smart Contracts: Cross-chain bridges often employ Smart Contracts to facilitate the transfer process, automating tasks and ensuring that the rules of each blockchain are respected.

There are several types of cross-chain bridges, each with its own strengths and weaknesses. Some of the most popular ones include:

- Trusted Relayers: These bridges rely on trusted intermediaries to facilitate the transfer process. While they’re easy to implement, they’re also vulnerable to single points of failure.

- Federations: These bridges use a network of nodes to verify and validate transactions. They offer higher security than trusted relayers but are also more complex to implement.

- Sidechains: These bridges enable the creation of separate blockchains that are connected to a main blockchain. They offer higher scalability than other bridge types but also come with higher security risks.

As the blockchain ecosystem continues to evolve, cross-chain bridges will play a vital role in shaping its future. By enabling interoperability between different blockchain networks, they’ll unlock new use cases, facilitate innovation, and pave the way for a more connected and seamless blockchain ecosystem.

But, cross-chain bridges are not without their challenges. They require immense technical expertise, and their implementation can be complex and time-consuming. Additionally, they also introduce new security risks, such as the potential for 51% attacks or front-running.

Despite these challenges, the benefits of cross-chain bridges far outweigh the costs. As the demand for interoperability continues to grow, we can expect to see more innovative bridging solutions emerge.